Chime – Mobile Banking

By Chime

OS: Android, IOs

Financial Apps, Banking Apps

Table of Contents

In today’s fast-paced world, online banking has become a necessity for many people. Chime makes financial management easier with online banking. With Chime, you can enjoy the convenience of banking from anywhere, with no monthly service fees or minimum balance requirements.

Chime provides a range of services that include checking and savings accounts, a secured credit card, and innovative features aimed at helping users manage their finances effectively. With Chime, customers can access their accounts 24/7, make mobile check deposits, send money to friends and family, and build credit without the need for a credit check.

Chime caters to a wide range of individuals who seek convenient and flexible banking solutions. Its services are particularly appealing to tech-savvy Millennial and Gen Z consumers who prefer mobile banking and value seamless digital experiences. Chime appeals to young professionals who prioritize convenience, transparency, and cost-effectiveness. They appreciate the ability to manage their finances on the go and seek tools that can help them save, build credit, and achieve financial goals.

What is Chime Banking

Chime is a leading financial technology (fintech) company that offers innovative online banking services to its customers. It’s important to note that Chime is not a traditional bank itself, but rather partners with established banks to provide its services. This unique approach allows Chime to leverage the infrastructure and regulatory frameworks of its partner banks while offering a modern and user-friendly banking experience.

Chime has strategic partnerships with Bancorp Bank, N.A., and Stride Bank, N.A., both of which are members of the Federal Deposit Insurance Corporation (FDIC). This partnership ensures that Chime customers’ deposits are protected up to the maximum limits provided by the FDIC. The collaboration between Chime and its partner banks allows for seamless integration and access to a wide range of banking services.

Chime has attracted a significant user base with its customer-centric approach. Currently, Chime serves millions of customers, and its user numbers continue to grow steadily. This growth can be attributed to the company’s commitment to providing convenient and user-friendly online banking services. Chime’s online banking platform is accessible 24/7, allowing customers to manage their finances anytime, anywhere.

Chime has established a vast network of ATMs nationwide. With over 60,000 fee-free ATMs available across the country, Chime customers can conveniently withdraw cash and perform other ATM transactions without incurring additional fees. This widespread ATM accessibility enhances the overall banking experience for Chime customers.

How to Open a Chime Banking Account and Set Up Direct Deposit

If you are looking for a simple and convenient way to manage your money, you might want to consider opening a Chime banking account. Chime is an online-only bank that offers a checking account, a savings account, and a debit card with no monthly fees, no minimum balance requirements, and no overdraft charges. Plus, you can get paid up to two days early with direct deposit.

In this blog post, I will show you how to open a Chime banking account and set up direct deposit in a few easy steps.

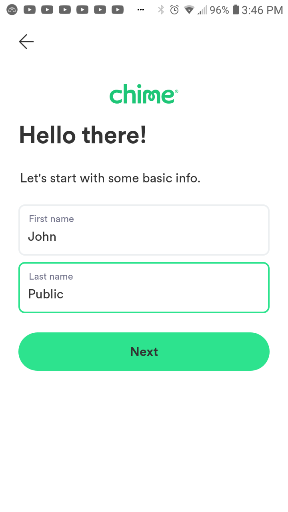

Step 1: Sign up for Chime

To open a Chime banking account, you need to visit the Chime website or download the Chime app on your smartphone. Chime has a great offer for using this referral link to get $100 when you open a spending account and Direct Deposit at least $200 within 45 days.

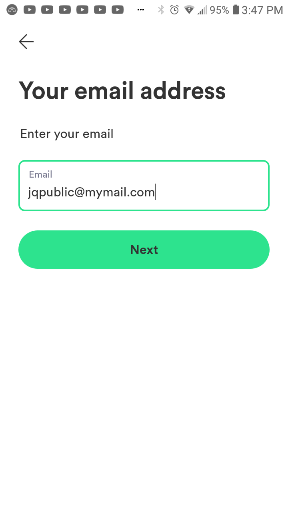

You will need to provide some basic information, such as your name, email address, phone number, date of birth, and Social Security number. You will also need to create a password and agree to the terms and conditions.

Chime will then verify your identity and send you a confirmation email. Once you confirm your email address, you can access your Chime account online or on the app.

Step 2: Activate your Chime debit card

After you sign up for Chime, you will receive your Chime debit card in the mail within 10 business days. To activate your card, you need to log in to your Chime account and tap on the “Card Status” tab. You will then be prompted to enter the last four digits of your card number and create a four-digit PIN.

You can use your Chime debit card to make purchases anywhere Visa is accepted, withdraw cash from over 60,000 fee-free ATMs, and transfer money to other Chime members instantly.

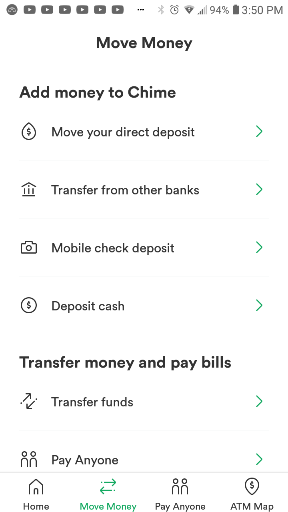

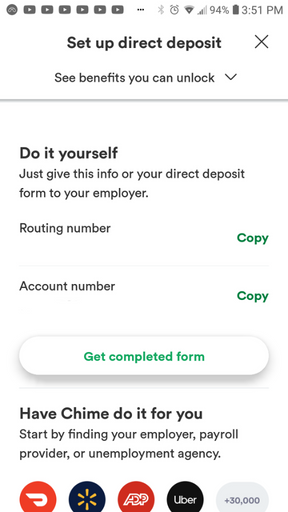

Step 3: Set up direct deposit

To set up direct deposit with Chime, you need to log in to your Chime account and tap on the “Move Money” tab. You will then see your routing number and account number, which you can use to fill out a direct deposit form from your employer or benefits provider.

Alternatively, you can use the “Email Me a Pre-Filled Direct Deposit Form” option to generate a PDF file that you can print or email to your employer or benefits provider.

Once you set up direct deposit with Chime, you can enjoy getting paid up to two days early, depending on when your employer or benefits provider submits the payment.

Key Features of Chime

Direct Deposits and Early Payment Feature: Benefits of Receiving Direct Deposits up to Two Days Early

Chime allows users to receive their direct deposits up to two days earlier than traditional banks. This feature can be particularly beneficial for individuals who rely on timely access to their funds, providing them with greater financial flexibility and convenience.

Early access to funds can help users cover their expenses, manage bills, and stay on top of their financial responsibilities.

To activate the early payment feature, users need to set up direct deposit to their Chime account. This involves providing their employer, payroll provider, or benefits payer with their Chime account and routing numbers. Once direct deposit is established, Chime automatically processes the payments and credits the funds to the user’s account up to two days earlier than the scheduled payment date.

Fee-Free Overdraft and SpotMe Service: Explanation of Fee-Free Overdraft up to $200

Chime offers a fee-free overdraft service known as SpotMe, which allows eligible users to overdraft their account by up to $200 without incurring any fees. This feature provides an added layer of financial flexibility, helping users avoid declined transactions and potential fees that are common with traditional overdraft services.

To qualify for SpotMe, users must typically have at least $200 or more in monthly direct deposits to their Chime account. SpotMe allows users to make debit card purchases and cash withdrawals beyond their available balance, up to the designated limit, without incurring any overdraft fees. Chime determines each user’s SpotMe allowance based on factors such as account history, direct deposit frequency and amount, spending activity, and other risk-based considerations.

Savings Accounts and Interest Rates: Overview of Chime’s High-Yield Savings Account

Chime offers a high-yield savings account to help users grow their savings and achieve their financial goals. With Chime’s savings account, users can securely deposit their money and earn interest on their balances, allowing their savings to grow over time. Chime’s high-yield savings account offers a competitive annual percentage yield (APY) that can potentially outperform traditional savings accounts offered by brick-and-mortar banks. Chime’s savings account has no minimum balance requirements or monthly fees, making it accessible and inclusive for individuals with varying levels of savings.

To open a Chime High-Yield Savings Account, it is necessary to have a Chime Checking Account. The Chime Checking Account serves as the gateway to accessing the benefits of the savings account. By linking the two accounts, you can seamlessly transfer funds between your checking and savings accounts and take advantage of Chime’s automated savings features.

Cash Deposits and Limitations: Support for Cash Deposits at Nationwide Retailers

Chime recognizes the importance of cash transactions and offers the convenience of cash deposits at various nationwide retailers. Users can deposit cash into their Chime account by visiting participating retailers, which can be a convenient option for those who prefer or rely on cash for certain transactions.

While Chime supports cash deposits, it’s essential to note that some retailers may charge a fee for this service. The specific fee amounts and retailer policies can vary, so users should review the terms and conditions or contact Chime customer support for detailed information on cash deposit fees.

Automated Savings Tools to Improve Financial Habits

Chime provides automated savings features that help users develop better financial habits. These tools make it easier to save by automatically setting aside a portion of funds into a savings account. Features like Round Ups, where transactions are rounded up to the nearest dollar with the difference deposited into savings, and Save When I Get Paid, which transfers a percentage of direct deposits to savings, encourage consistent savings growth.

Pros and Cons of Chime

Pros

- Competitive Savings APY

- Early Direct Deposit Feature

- Access to a Large Network of ATMs

- Credit Building with No Credit Check and Fees

Cons

- Lack of Physical Branches for In-Person Service

- Mobile Check Deposit Only for Direct Deposit Recipients

- Recent Customer Complaints Regarding Account Access and Funds

Pros

Competitive Savings APY

Chime offers a competitive Annual Percentage Yield (APY) on its savings accounts. This means that users can earn higher interest on their savings compared to traditional brick-and-mortar banks. The competitive APY allows users to grow their savings faster and maximize their earning potential.

Early Direct Deposit Feature

With Chime, users can receive their direct deposits up to two days earlier than traditional banks. This early access to funds can be particularly beneficial for individuals who rely on timely access to their paychecks. Early direct deposit allows users to manage their finances more effectively, meet financial obligations, and even save for future goals sooner.

Access to a Large Network of ATMs

Chime provides access to a vast network of fee-free ATMs nationwide. Users can conveniently withdraw cash or check their balances without incurring additional fees.

The extensive ATM network ensures that users can easily access their funds and perform necessary transactions wherever they are.

Credit Building with No Credit Check and Fees

Chime offers a credit-building opportunity with its Secured Chime Credit Builder Visa Credit Card. This card allows users to build their credit history without the need for a credit check or upfront security deposit. By responsibly using the Credit Builder card and making timely payments, users can establish or improve their credit scores, opening doors to better financial opportunities in the future.

Cons

Lack of Physical Branches for In-Person Service

One limitation of Chime is the absence of physical branches. As a primarily online banking platform, Chime does not offer in-person services or branch locations. While Chime provides excellent digital banking capabilities, individuals who prefer face-to-face interactions or need specialized services may find the lack of physical branches inconvenient.

Mobile Check Deposit Availability Only for Direct Deposit Recipients

Chime’s mobile check deposit feature is limited to users who receive direct deposits. This means that individuals who primarily rely on other forms of income, such as cash or paper checks, may not have access to this convenient deposit method. Users without direct deposits may need to explore alternative ways of depositing funds into their Chime accounts.

Recent Customer Complaints Regarding Account Access and Funds

Chime has received some customer complaints concerning difficulties accessing their accounts or encountering issues with fund availability. While Chime strives to provide a seamless banking experience, occasional customer complaints highlight the importance of being aware of potential challenges and contacting Chime’s customer support for timely resolution.

Chime Credit Builder Visa Credit Card

In addition to its banking services, Chime offers a credit card option known as the Secured Chime Credit Builder Visa Credit Card. Designed to help individuals build or improve their credit, this card provides a valuable opportunity to establish a positive credit history.

The Secured Chime Credit Builder Visa Credit Card is a type of secured credit card that requires a security deposit as collateral. By making timely payments and demonstrating responsible credit behavior, cardholders can establish creditworthiness and increase their credit scores.

Eligibility Requirements and Benefits of the Credit Builder Card

One of the significant advantages of the Secured Chime Credit Builder Visa Credit Card is that it does not require a credit check for approval. This makes it accessible to individuals who may have limited or poor credit history.

Secured Card Usage and Repayment Process

The Secured Chime Credit Builder Visa Credit Card functions like a regular credit card. Cardholders can use it for purchases and payments, just like any other credit card. However, they must provide a security deposit as collateral, which determines their credit limit.

Reporting to Major Credit Bureaus

Chime reports cardholders’ payment activities to the three major credit bureaus: Equifax, Experian, and TransUnion. This reporting helps individuals establish a positive credit history and demonstrate their creditworthiness to future lenders.

No Interest, Annual Fees, or Upfront Security Deposit

The Secured Chime Credit Builder Visa Credit Card offers several financial benefits to its users. Firstly, it does not charge any interest on purchases made with the card. Additionally, there are no annual fees associated with the card, providing cardholders with cost savings. Lastly, Chime does not require an upfront security deposit when opening the account, making it more accessible to those who may have limited funds.

Relationship Between the Credit Builder Card and Chime Checking Account

To be eligible for the Secured Chime Credit Builder Visa Credit Card, applicants must have a Chime Checking Account. The Chime Checking Account serves as the primary account for managing finances and making payments toward the credit card balance. By linking the two accounts, individuals can easily track their spending, make payments, and stay in control of their credit-building journey.

Chime Mobile App and Access on the Go

Chime understands the importance of convenience and accessibility in today’s digital age. As such, their mobile app takes center stage as the primary method for customers to access and manage their accounts. With the Chime mobile app, users can enjoy a seamless banking experience right at their fingertips.

Daily Balance Notifications and Transaction Alerts

The Chime mobile app provides users with real-time updates on their account balance. They can set up notifications to receive daily balance summaries and transaction alerts, ensuring they stay informed about their financial activities.

Disabling Transactions and Managing Card Security

In the event of a lost or stolen card, the Chime mobile app allows users to take immediate action. They can disable transactions, preventing unauthorized access and protecting their funds. This feature eliminates the need for lengthy customer service calls and provides peace of mind.

Integration with Mobile Wallets (Apple Pay, Google Pay)

Chime’s mobile app seamlessly integrates with popular mobile wallets such as Apple Pay and Google Pay. This integration enables users to make secure and convenient payments with their Chime debit card using their smartphones. With just a few taps, users can pay for purchases both online and at participating merchants.

Access to a Large Network of ATMs and Fee Avoidance

Chime users enjoy access to a vast network of fee-free ATMs. The Chime mobile app provides a convenient ATM locator feature, helping users find nearby ATMs where they can withdraw cash without incurring additional fees. By utilizing Chime’s network of ATMs, users can avoid unnecessary charges.

Mobile Check Deposit Functionality

Gone are the days of visiting a physical bank branch to deposit checks. Chime’s mobile app offers a convenient and secure mobile check deposit feature. Users can simply snap photos of their checks within the app, and the funds are deposited directly into their Chime account, saving time and effort.

Dealing with Lost or Stolen Cards

In the unfortunate event of a lost or stolen card, Chime users can easily handle the situation through the mobile app. They can report the incident and disable the card to prevent unauthorized transactions. Furthermore, Chime offers free debit card replacement, allowing users to request a new card directly within the app.

Chime Fees

Overview of Chime’s Fee Structure

- Minimum Balance Fees:

- Monthly Fees:

- Maintenance Fees:

- Maintenance Fees:

- Direct Deposit Fees:

- Overdraft Fees (with SpotMe):

- ATM Withdrawl Fee:

- $0

- $0

- $0

- $0

- $0

- $0 With SpotMe up to $200

- $2.50 for out of network ATMs. Third-Party ATM fees may apply.

Chime prides itself on offering a fee-friendly banking experience. Unlike traditional banks that burden customers with various fees, Chime keeps its fee structure simple and transparent. Let’s explore the key aspects of Chime’s fee system.

Minimum Balance Fees:

Chime does not impose any minimum balance requirements. Whether you have a large sum or a modest amount in your account, you won’t have to worry about maintaining a minimum balance to avoid fees.

Monthly Fees:

Chime does not charge monthly maintenance fees. You can enjoy the benefits of their banking services without incurring any recurring charges.

Maintenance Fees:

Chime also eliminates maintenance fees that are often associated with traditional bank accounts. You can keep your Chime account active and accessible without paying any additional fees.

Direct Deposit Fees:

Chime does not charge any fees for direct deposits. You can enjoy the convenience of having your funds deposited directly into your Chime account without incurring any extra costs.

Overdraft Fees (with SpotMe):

With Chime’s SpotMe service, eligible customers can access fee-free overdraft up to $200. You won’t have to worry about expensive overdraft fees if you find yourself in need of a little extra financial cushion.

ATM Withdrawal Fee:

Chime assesses a $2.50 fee when you withdraw cash at an out-of-network ATM. This fee helps cover the costs associated with using ATMs that are not part of Chime’s designated fee-free network.

Potential Third-Party Fees:

It’s important to note that while Chime does not charge additional fees for out-of-network ATM withdrawals, the ATM operator may still impose their own third-party fee. These fees are determined by the ATM operator and are separate from Chime’s charges.

Understanding Chime’s fee structure allows you to make informed decisions and manage your finances effectively. By eliminating common fees found in traditional banks, Chime provides a fee-friendly environment for its customers. While there is a nominal fee for out-of-network ATM withdrawals, Chime’s extensive network of fee-free ATMs helps minimize the need for such transactions. Keep in mind that any third-party fees charged by ATM operators are beyond Chime’s control. Overall, Chime’s commitment to fee transparency ensures that you can enjoy the benefits of their banking services without worrying about unnecessary charges.

Frequently Asked Questions (FAQs)

To address common questions about Chime’s online banking services, here are some frequently asked questions:

Does Chime offer online banking services?

Yes, Chime offers online banking services through its partner banks. You can open a checking account with no monthly fees and a high-yield savings account with automatic savings features. Chime also provides additional services like the Chime Credit Builder Secured Visa® Credit Card.

How to open a bank account online through Chime?*

Opening a bank account online with Chime is a straightforward process. You’ll need your Social Security number, email address, and a valid home address. Once Chime reviews and confirms your information, you can start banking online. All members must be U.S. citizens and at least 18 years old.

Can you open an account without a deposit?

Yes, Chime allows you to open a checking account without an opening deposit. There are no fees charged for opening an account without a deposit, making it accessible to everyone.

Is a credit check required to open a bank account online?

Chime does not require a credit check to open an online bank account. They aim to provide inclusive services to all Americans, including those with bad credit histories. You can open and use a checking or savings account entirely online, with no opening deposit required.

How to deposit money into a Chime account?

Chime offers various options to deposit money into your account. You can link an external bank account to set up transfers. Additionally, you can set up direct deposit from your employer or payroll provider to receive funds directly into your Chime account. Chime also enables fee-free cash deposits at Walgreens and other retailer locations.

Deposit cash at Walgreens

To deposit cash at Walgreens, go to the register and give the cashier your money and Chime Visa® Debit Card. Your funds will be available in your account within minutes. When depositing cash at Walgreens, there are limits to be aware of:

Three deposits per day

$1,000 per day

$10,000 per calendar month

Deposit cash at other retailers

You can also deposit cash at other retailers, but there may be a fee. To find a retailer that accepts cash deposits, open the Chime app and tap “Move Money.” Then, select “Deposit Cash” and you’ll see a list of nearby locations.

Using ATMs with Chime

You can’t deposit cash at an ATM, but you can withdraw cash at more than 60,000 fee-free ATMs.

Conclusion

In conclusion, Chime’s online banking services offer a simplified and convenient way to manage your finances. With no monthly fees, easy access to funds, user-friendly features, and robust security measures, Chime stands out as an excellent choice for your banking needs. Simplify your banking experience and join the millions of satisfied Chime users who enjoy hassle-free online banking.

For more information and assistance, you can visit Chime’s website, read their privacy notice, explore their help center, or contact their support team.